Hedge Guide

One of the core features of SIL is to bet on long or/and short, which essentially utilize the AMM protocol and SIL’s LP composition at the same time. It requires users to have some pre-judgements of the market, the best practice is to stake long-term bullish, short-term bearish assets.

The benefit of using SIL’s hedge instead of controlling positions manually or using contract, is that:

- SIL’s hedging can’t get you liquidated, it’s has a mild curve as the UNI v2 curve

- Relative price(A/B assets) impact () will be reduced to

At the moment, SIL’s HEDGING mode has been launched on Ethereum and Binance Smart Chain. Each chain supports different trading pairs on different swaps, but the mechanism is the same.

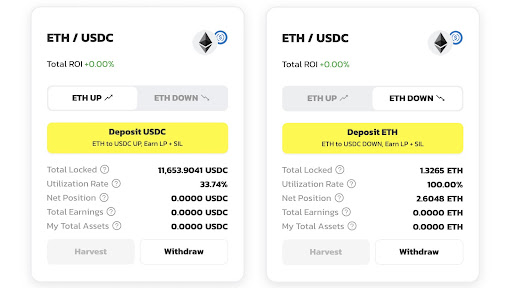

Let's take the following pairs as two examples.

Take the ETH/USDC trading pair as an example. Since going long and shorting essentially utilized the UNI v2’s , after SIL composed user’s assets into LP forms, if ETH rises, a portion of the ETH in the LP will be sold to USDC, the quantity of ETH will be decreased and the quantity of USDC will be increased; correspondingly, if ETH falls, some USDC in LP will be exchanged to ETH, so the quantity of ETH will be increased, and the quantity of USDC will be reduced.

If one thinks that ETH has a high probability of rising in the short term, but does not want to buy ETH with USDC in hands or whatever assets he has, then he can choose to pledge USDC. If ETH rises as anticipated, then the quantity of USDC in the user's hand will increase, thus gaining the benefits of ETH rising. On the contrary, if the user holds ETH in his hand, he is bearish in the short term on ETH but does not want to sell the ETH in his hand for the long term bullish, then he can choose to pledge ETH. If ETH falls, the amount of ETH in his hand will increase, but the user will get more quantity of ETH for the long term.

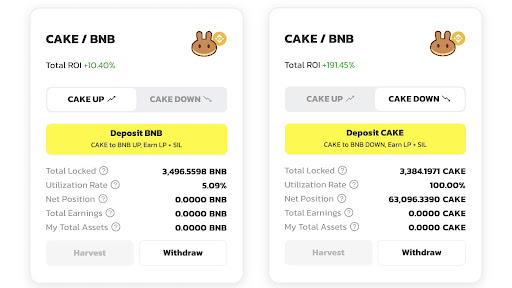

Taking the CAKE/BNB trading pair as an example, if CAKE rises relative to BNB (or the fiat value of CAKE is rising over the fiat value of BNB), then in the LP composed by CAKE/BNB, the number of BNB will be decreased, and the number of CAKE will be Increased.

If the user believes that the probability of CAKE rising is greater than that of BNB, then he can choose to pledge BNB. If CAKE rises as desired, the number of BNB in the user's hand will be increased and captured the benefits of the price increase of CAKE; if the user feels the probability of CAKE falling in the near future is larger than BNB, but you don’t want to sell the CAKE on your hand, you can choose to pledge the CAKE. If CAKE falls, the number of CAKE in the user's hand will be increased, which can reduce the loss of the user caused by the fall of the price of the cake.

What needs to be clear is that in the HEDGING mode, when users withdraw(release their LP), the number of tokens displayed on the UI interface is exactly how much the user will receive, and there will be no impermanent-loss mitigation.

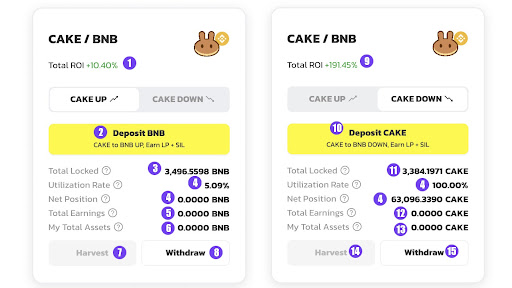

- Long CAKE’s total ROI, this number relates to how much BNB this pool has.

- If it is believed that the probability of CAKE rising is greater than that of BNB, then BNB should be pledged into the pool. One can earn BNB + SIL tokens along the way.

- Total locked assets: 3,496.5611 $BNB, this number relates to the Long CAKE side’s total ROI.

- The utilization rate for long CAKE is 5.09%, the matching gap is 0 BNB, and the utilization rate for short CAKE is 100%, and the matching gap is 63,096.0717 CAKE. The party with a utilization rate of 100% indicates that the funds on this side have all been matched, and there is still a shortage of 63,096.0717 CAKEs to be 100% matched on the other side. Since SIL’s product combines the single assets of two sides into LP, unlike normal LP farming, one address has to provide two tokens (50% A token + 50% B token) exactly, the possible situation in SIL would be that there are more coins on one side and fewer coins on another side.

- It is believed that the probability of CAKE rising is greater than that of BNB, click to deposit BNB. If the direction is judged incorrectly, the amount displayed here is 0(fixed in a recent upgrade of SIL frontend, now this number shows real loss).

- The total amount of BNB of the logged in address in this pool. The total amount = the user's BNB principal amount ± the amount of BNB earned/lost.

- One can withdraw the SIL profits individually, which is related to the number of BNB pledged by the user and the total ROI of the Long CAKE’s side.

- Redeem BNB assets, the maximum is the amount of BNB displayed on the interface, in the meanwhile, SIL will also be claimed at the same time.

- The total return of shorting CAKE, this number relates to how much CAKE this pool has.

- If it is believed that the probability of CAKE falling is greater than that of BNB, then CAKE should be pledged into the pool. One can earn CAKE + SIL tokens along the way.

- Total locked assets: 3,384.1899 $CAKE, this number relates to the Short CAKE side’s total ROI.

- It is believed that the probability of CAKE falling is greater than that of BNB, click to deposit CAKE. If the direction is judged incorrectly, the amount displayed here is 0(fixed in a recent upgrade of SIL frontend, now this number shows real loss).

- The total amount of CAKE of the logged in address in this pool. The total amount = the user's CAKE principal amount ± the amount of CAKE earned/lost.

- One can withdraw the SIL profits individually, which is related to the number of CAKE pledged by the user and the total ROI of the Short CAKE’s side.

- Redeem CAKE assets, the maximum is the amount of CAKE displayed on the interface, in the meanwhile, SIL will also be claimed at the same time.