Overview

Brief Intro

Let's discover Sister in Law in less than 5 minutes.

Sil.finance https://sil.finance/ is the world's first decentralized LP composer that purely built on smart contracts technologies, to user's concept, it's a single sided yield aggregator (1 click hedging) with adventurous functional #NFT farming card add-ons. SIL focuses on providing users with unique DeFi2.0 Financial Management experiences with creative recreations.

SIL currently offers:

- Type1: YIELD farms: Single token mining on top of LP farms which have much higher yields than traditional single token pools (employs LP composition).

- Automatic passive Impermanent Loss Mitigation for all farms of type1. (profiting users mitigate losing users within the farm).

- Type2: HEDGE farms: Single token hedging on top of LP farms, users get 2x leverage alike experience simply by depositing (use AMM's X * Y = K).

- Automatic yield compounding (user triggers or bot triggers, with minimal resolution set to 1 hour).

- NFT addon to speedup mining process, or slow down someone else's, or yourselves.

- Multi-chain coverage:

- Ethereum

- Binance Smart Chain (BSC)

- Okexchain (OEC)

- Polygon

- Support quality swaps on each chain.

The SIL’s model is unique on the DeFi market, it’s single-sided functionality is solely contributed by users, the product gives all the possible choices back to the community and is way more open than yield products.

Under the hood, SIL employs:

- Isolated ordering queue, each pool contains:

- Pending queue

- Priority queue

- LP composition (share based matching algorithm)

- Share accumulator

- Asynchronous settlement calculator

- Synchronous settlement calculator with double output emitter

SIL's WIP features includes:

- Profit amplification by moving LP profits to profit token's Single Token yield farm and auto compound there.

- SIL Single Token Yield farm to earn this aggregated profits.

- LP composition (1:n matching algo, in development)

- Per address pairing ring

- Per pair-unit per deposit with:

- Point-in-time LP price (materialized)

- 1:n relation records

- Local IL mitigation

- LP shadowing

- Opens type3: LENDING farms

- SIL itself arbitrage against market and route profits among SIL's YIELD farms, HEDGE farms and LENDING farms.

- Free NFT marketplace

- The marketplace offers free self-listing of any legit ERC-721 tokens

- The marketplace allows seller to set any ERC-20 tokens for the currency

- Multi-chain coverage:

- Polygon

- Cadano

- Avalanche

The revenue of mining will be distributed to all users in proportion, there is no intermediary, no principal commission fees. It’s fair and just. The platform is jointly built by crypto enthusiasts from all over the world, and the management of the platform is entrusted to all SIL holders.

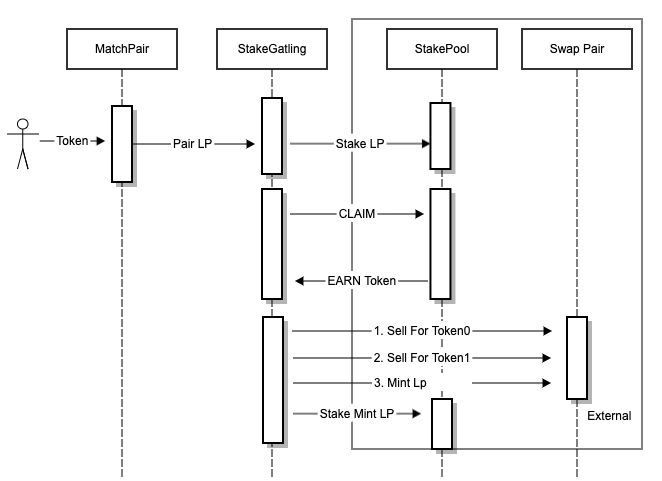

SIL features a three-tier architecture: SIL Master, MatchPair and StakeGatling.

SIL Master is the entry management contract, processing transactions and the distribution of SIL Token. MatchPair is responsible for matching. The matching queue adopts a first-in-last-out model to ensure that users who recharge first are matched first. When the matching party withdraws funds, the queue adopts the last-in-first-out model. It also ensures that users with priority recharge are in a relatively safe queue position. StakeGatling is responsible for collateralizing the matched LP to the mining contract. And then according to the configuration strategy, it will automatically roll out the profit, CLAIM income and convert the income of CLAIM into LP through Swap/Mint, and re-mortgage to obtain income to ensure the maximum benefit.

Features of SIL

- LP Grouping: Similar concept to the DeFi “Vault”. For instance, user_A holds ETH but not USDT, user_B holds USDT but not ETH; “B” wants to participate in the mining to gain interest; while due to ETH’s price soars, “‘B” does not want to convert USDT to ETH to participate; SIL provides a liquidity pool that matches (grouping) user_A’s ETH with user_B’s USDT as a bundle to participate. This pool halving the risks for both user_A and user_B, mutually benefits both of the users in a P2P dual-mining model.

- Compound interest mechanism

- Multiple Gain: Based on the LP matching mechanism, besides gaining compounding interest on the original digital asset(s) investment, SIL token is issued to participants through such a mining process.

SIL Products

- Hedging

- Yield

- xSIL Single Token Yield

- NFT(BSC)

- Lounge(OEC/Polygon)